Need a new or used car now because your older ride is on it’s way out? Before you rush out to go on the hunt take some time to read our take on to possibly save on your hard earned cash.

Welcome to the automotive frontier where the race to own a new car feels like an elite club only a select few can join. Recent statistics are astonishing, and they paint a grim picture for the middle-income earner. Let’s first look at some key facts that depict the current landscape:

- Average New Car Loan: $760 per month

- Year-over-Year Price Increase: 30-35% compared to 2020

- Trend in Used Cars: Prices are rising too, making new car affordability more elusive.

- Age of Older Cars on the Road: 12 years

Given these numbers, it’s not difficult to see why many are opting to stick with their older models.

The Skyrocketing Costs

Year-over-year, we’re seeing a rise of about 30-35% in the price of new cars compared to 2020. This kind of surge puts a massive dent in the plans of the average person earning $100,000 per year or less. With the average new car loan sitting at a hefty $760 per month, it’s clear that owning a new car is becoming an unaffordable dream for many.

This trend is especially alarming when you’re eyeing specialized models like unibody SUVs or PHEV SUVs, which come with their own sets of advantages but also premium price tags.

The Impact on Used Car Prices

Traditionally, used cars have been a fallback for those unable to afford new ones. However, the growing demand for new cars is trickling down and inflating used car prices. This ripple effect further exacerbates the issue of new car affordability.

Possible Solutions and Alternatives

While the market forces are currently against the average buyer, all hope is not lost. Here are some avenues you might consider:

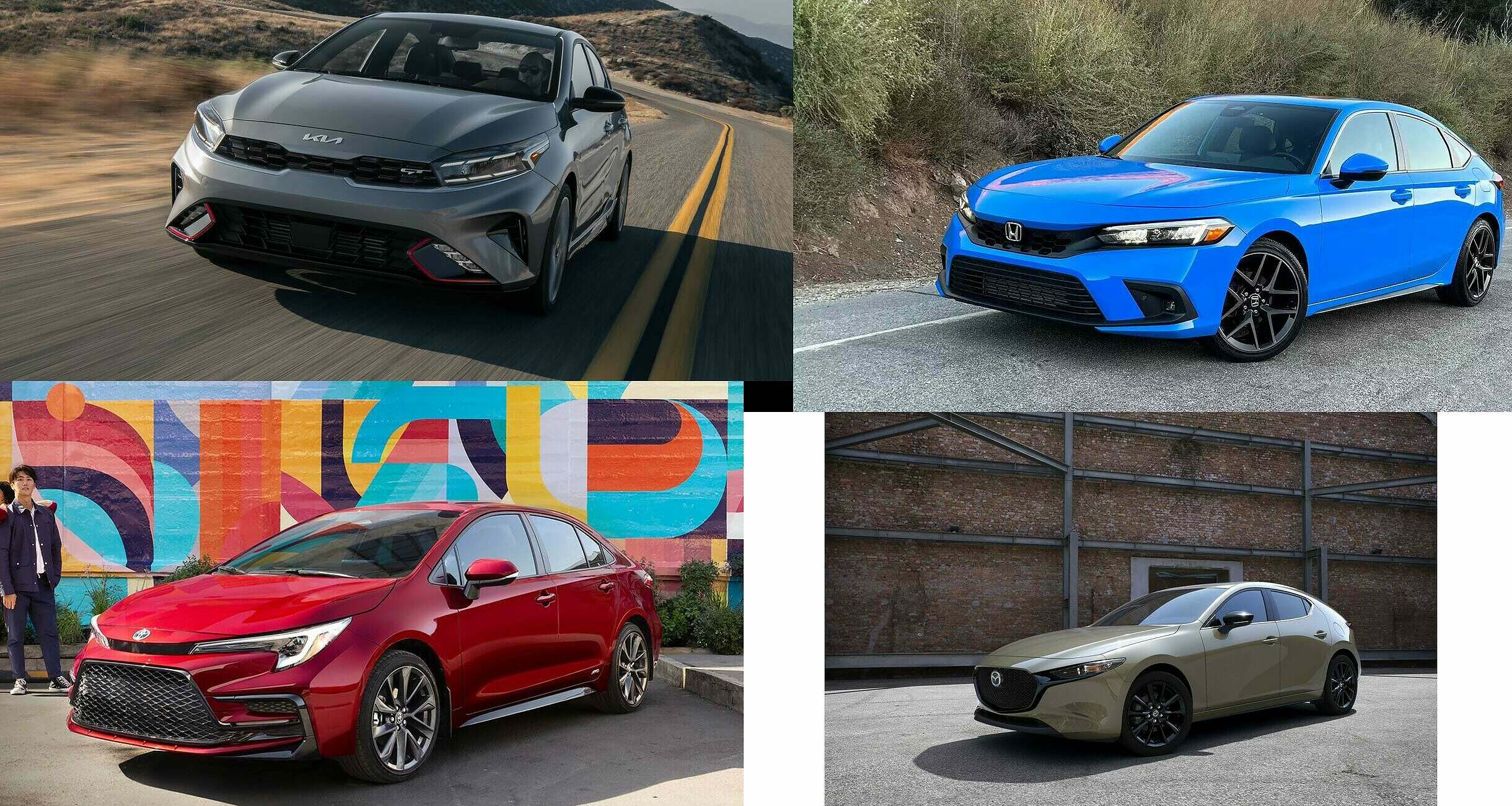

- Choosing Compact or Subcompact Models: SUVs like subcompact and compact models offer a more affordable entry point into car ownership.

- Opting for Cars with Lower Features: Vehicles with fewer luxuries like heads-up displays can save you a lot on the total price.

- Long-Term Maintenance: Older cars may be cheaper initially, but long-term costs can add up. Be proactive with rust prevention and other maintenance.

Conclusion

In today’s volatile automotive market, the average person making $100,000 per year or less faces an uphill battle. However, with savvy choices and diligent research, navigating this maze is still possible.

Whether you’re in the market for a performance SUV or just something to get you from point A to B, keep these factors in mind, and happy car shopping!

This article is part of our ongoing series exploring the intricacies of the car market. Stay tuned for more!