When it comes to choosing a vehicle, the debate between SUVs and sedans can seem endless. Beyond fuel efficiency and space, there’s another factor that might tip the scales for you – insurance costs.

If you’re need a new or slightly used car and narrowed your choices between a Sedan and an SUV – let’s help choose. A question for the ages is; SUV or sedan, which one is more economical to insure yearly?

SUVs and Insurance

Let’s first look at Sports Utility Vehicles and how their yearly insurance costs will affect your monthly budget – in theses inflationary times.

A Comprehensive Look at SUV insurance

SUVs have surged in popularity, but does this love affair extend to their insurance costs? Interestingly, certain SUV models are renowned for having lower insurance rates. These vehicles strike a balance between robustness and economy, making them a hot choice for families and individuals alike.

- Lower Risk Profile: SUVs are often perceived as safer, translating to lower insurance premiums.

- Telematics Devices: Installing telematics devices can further reduce the insurance cost of your SUV.

What about old (Classic) SUVs and Insurance?

For those with a penchant for vintage, insuring a classic SUV doesn’t have to break the bank. Specialized insurance companies offer tailored packages, ensuring that your classic beauty is well-protected without draining your wallet.

Protip: Stick with the Same Company save even more money

Did you know that loyalty can actually pay off when it comes to insurance? Sticking with the same company can yield discounts, making your SUV even cheaper to insure yearly.

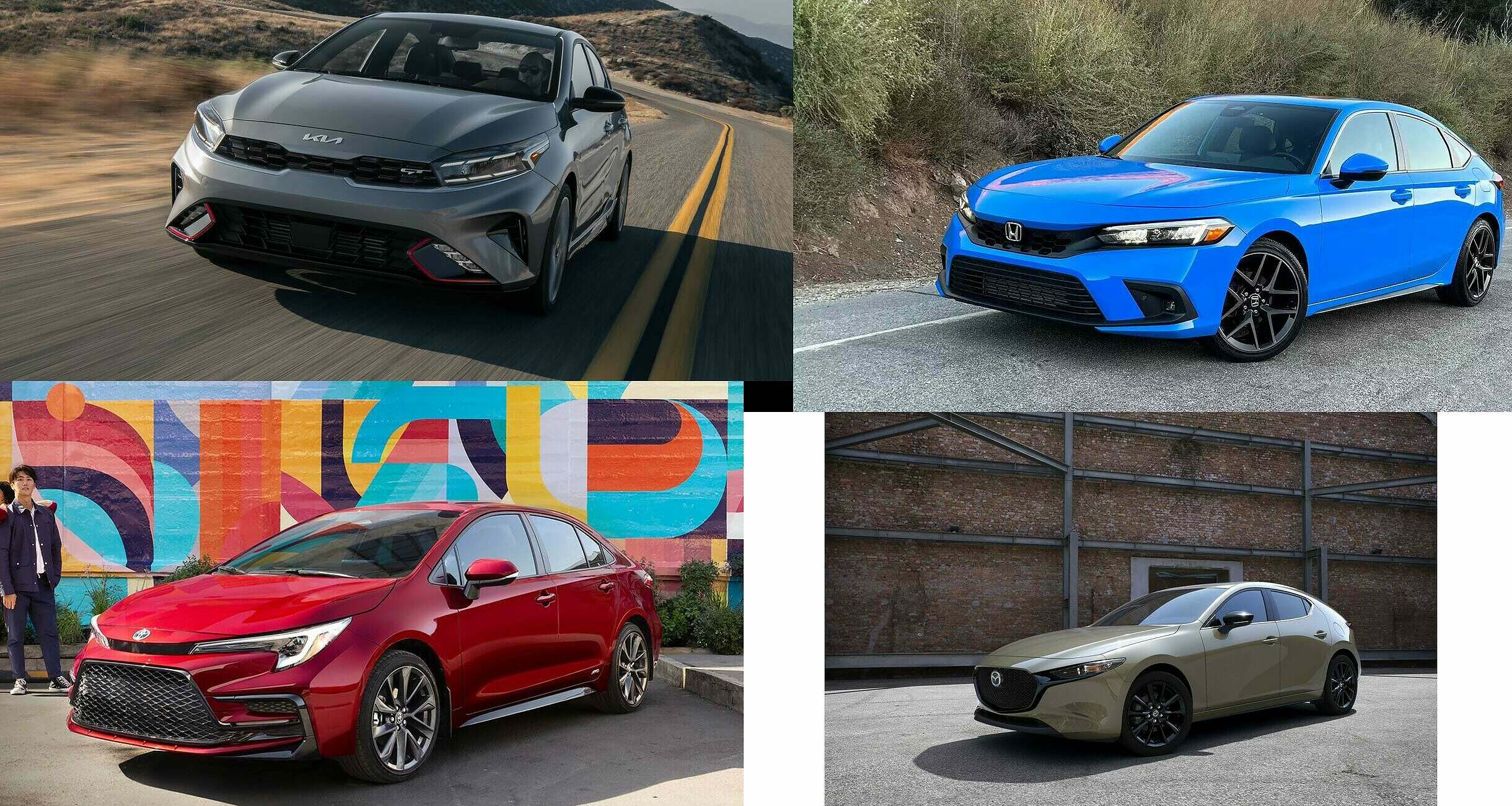

Sedans and Insurance: The Lowdown

Sedans have long been the epitome of efficiency and compactness, but how do they fare on the insurance front?

- Size and Safety: Sedans are generally smaller and lighter, which might result in higher insurance costs due to perceived vulnerability.

- Fuel Efficiency: The fuel efficiency of sedans can sometimes translate to lower insurance premiums.

Tips for New Sedan Drivers

If you’re a new sedan driver looking to pinch pennies, fret not! There are effective tips to help you save on car insurance, ensuring that your ride remains affordable.

Savvy Insurance Strategies

Whether you’re a sedan enthusiast or a prospective buyer, employing smart strategies can substantially lower your insurance costs, making sedans an attractive option.

The Verdict: SUV or Sedan?

So, which reigns supreme in the realm of insurance costs? The answer is not so black and white. It largely depends on factors such as the make and model of the vehicle, your driving history, and the insurance company you choose.

Conclusion

Choosing between an SUV and a sedan involves weighing various factors, with insurance costs being a significant one. While some SUVs boast surprisingly low insurance rates, sedans aren’t far behind, especially when armed with savvy insurance strategies.

Ultimately, the choice boils down to individual preferences, needs, and a bit of insurance shopping smarts. Happy driving and insuring!